Condo Insurance in and around Red Bluff,

Get your Red Bluff, condo insured right here!

Insure your condo with State Farm today

Welcome Home, Condo Owners

With the variety of condo insurance options to choose from, you may be feeling overwhelmed. That's why we made choosing State Farm straightforward. As one of the leading providers of condo unitowners insurance, you can enjoy impressive service and coverage that is competitively priced. And this is not only for your condo unit but also for your personal belongings inside, including things like cookware, mementos and furnishings.

Get your Red Bluff, condo insured right here!

Insure your condo with State Farm today

Why Condo Owners In Red Bluff, Choose State Farm

Everyone knows having condominium unitowners insurance is essential in case of a windstorm, ice storm or hailstorm. Sufficient condo unitowners insurance ensures that your condo can be rebuilt, so you aren’t stuck making payments for a home you can’t live in. Another helpful thing about condo unitowners insurance is that it also covers you in certain legal cases. If someone slips due to your careless error, you could be on the hook for the cost of their recovery or their hospital bills. With good condo coverage, you have liability protection in the event of a covered claim.

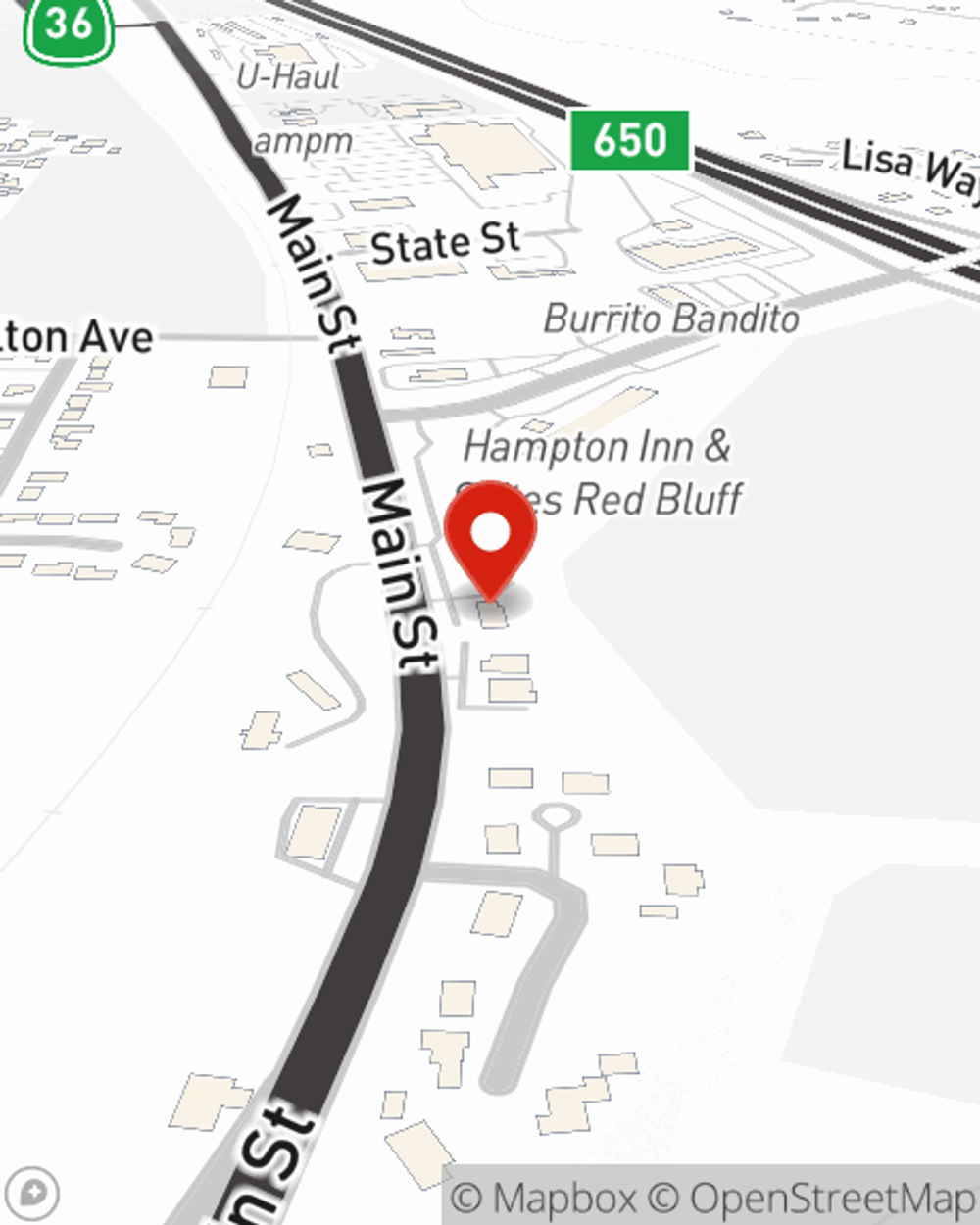

As a dependable provider of condo unitowners insurance in Red Bluff,, CA, State Farm helps you keep your home protected. Call State Farm agent Hector Garnica today for help with all your condominium unitowners insurance needs.

Have More Questions About Condo Unitowners Insurance?

Call Hector at (530) 527-9922 or visit our FAQ page.

Simple Insights®

How to choose a neighborhood that is right for you

How to choose a neighborhood that is right for you

The trick to choosing a neighborhood to live in is to figure out what matters to you and to do thorough research.

Do you need earthquake insurance if you don't live on the coast?

Do you need earthquake insurance if you don't live on the coast?

According to USGS, various U.S. locations have experienced earthquakes of magnitude four or more in recent years. Earthquake insurance can be valuable to all homeowners.

Hector Garnica

State Farm® Insurance AgentSimple Insights®

How to choose a neighborhood that is right for you

How to choose a neighborhood that is right for you

The trick to choosing a neighborhood to live in is to figure out what matters to you and to do thorough research.

Do you need earthquake insurance if you don't live on the coast?

Do you need earthquake insurance if you don't live on the coast?

According to USGS, various U.S. locations have experienced earthquakes of magnitude four or more in recent years. Earthquake insurance can be valuable to all homeowners.